Euro

Background Information

SOS Children offer a complete download of this selection for schools for use on schools intranets. Click here for more information on SOS Children.

| Euro | |||

|---|---|---|---|

| ευρώ (Greek) евро (Bulgarian) | |||

|

|||

| ISO 4217 code | EUR (num. 978) | ||

| Central bank | European Central Bank | ||

| Website | www.ecb.europa.eu | ||

| Official user(s) |

Outside the EU (8)

|

||

| Unofficial user(s) |

3 other users

|

||

| Inflation | 1.4%, December 2012 | ||

| Source | ECB, June 2009 | ||

| Method | HICP | ||

| Pegged by |

10 currencies

|

||

| Subunit | |||

| 1/100 | cent actual usage varies depending on language |

||

| Symbol | € | ||

| Nickname | The single currency local names

|

||

| Plural | See Euro linguistic issues | ||

| cent | See article | ||

| Coins | 1c, 2c, 5c, 10c, 20c, 50c, €1, €2 | ||

| Banknotes | €5, €10, €20, €50, €100, €200, €500 | ||

| Printer |

Several, click to

|

||

| Website |

Several, click to

|

||

| Mint |

Several, click to

|

||

| Website |

Several, click to

|

||

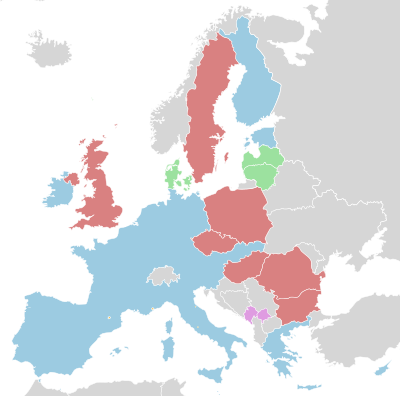

The euro ( sign: €; code: EUR) is the currency used by the Institutions of the European Union and is the official currency of the eurozone, which consists of 17 of the 27 member states of the European Union: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. The currency is also used in a further five European countries and consequently used daily by some 332 million Europeans. Additionally, more than 175 million people worldwide—including 150 million people in Africa—use currencies pegged to the euro.

The euro is the second largest reserve currency as well as the second most traded currency in the world after the United States dollar. As of March 2013, with almost €920 billion in circulation, the euro has the highest combined value of banknotes and coins in circulation in the world, having surpassed the US dollar. Based on International Monetary Fund estimates of 2008 GDP and purchasing power parity among the various currencies, the eurozone is the second largest economy in the world.

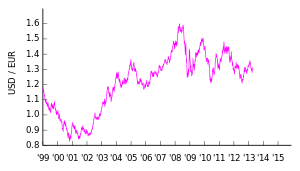

The name euro was officially adopted on 16 December 1995. The euro was introduced to world financial markets as an accounting currency on 1 January 1999, replacing the former European Currency Unit (ECU) at a ratio of 1:1 (US$1.1743). Euro coins and banknotes entered circulation on 1 January 2002. While the euro dropped subsequently to US$0.8252 within two years (26 October 2000), it has traded above the US dollar since the end of 2002, peaking at US$1.6038 on 18 July 2008. Since late 2009, the euro has been immersed in the European sovereign-debt crisis which has led to the creation of the European Financial Stability Facility as well as other reforms aimed at stabilising the currency. In July 2012, the euro fell below US$1.21 for the first time in two years, following concerns raised over Greek debt and Spain's troubled banking sector.

Administration

The euro is managed and administered by the Frankfurt-based European Central Bank (ECB) and the Eurosystem (composed of the central banks of the eurozone countries). As an independent central bank, the ECB has sole authority to set monetary policy. The Eurosystem participates in the printing, minting and distribution of notes and coins in all member states, and the operation of the eurozone payment systems.

The 1992 Maastricht Treaty obliges most EU member states to adopt the euro upon meeting certain monetary and budgetary convergence criteria, although not all states have done so. The United Kingdom and Denmark negotiated exemptions, while Sweden (which joined the EU in 1995, after the Maastricht Treaty was signed) turned down the euro in a 2003 referendum, and has circumvented the obligation to adopt the euro by not meeting the monetary and budgetary requirements. All nations that have joined the EU since 1993 have pledged to adopt the euro in due course.

Characteristics

Payments clearing, electronic funds transfer

Capital within the EU may be transferred in any amount from one country to another. All intra-EU transfers in euro are treated as domestic transactions and bear the corresponding domestic transfer costs. This includes all member states of the EU, even those outside the eurozone providing the transactions are carried out in euro. Credit/debit card charging and ATM withdrawals within the eurozone are also treated as domestic transactions, however paper-based payment orders, like cheques, have not been standardised so these are still domestic-based. The ECB has also set up a clearing system, TARGET, for large euro transactions.

Currency sign

A special euro currency sign (€) was designed after a public survey had narrowed the original ten proposals down to two. The European Commission then chose the design created by the Belgian Alain Billiet. The official story of the design history of the euro sign is disputed by Arthur Eisenmenger, a former chief graphic designer for the EEC, who claims to have created it as a generic symbol of Europe.

Inspiration for the € symbol itself came from the Greek epsilon (Є) – a reference to the cradle of European civilization – and the first letter of the word Europe, crossed by two parallel lines to 'certify' the stability of the euro.— European Commission

The European Commission also specified a euro logo with exact proportions and foreground and background colour tones. While the Commission intended the logo to be a prescribed glyph shape, font designers made it clear that they intended to design their own variants instead. Typewriters lacking the euro sign can create it by typing a capital 'C', backspacing and overstriking it with the equal ('=') sign. Placement of the currency sign relative to the numeric amount varies from nation to nation, but for texts in English the symbol (and the ISO-standard "EUR") should precede the amount.

History

Introduction

The euro was established by the provisions in the 1992 Maastricht Treaty. To participate in the currency, member states are meant to meet strict criteria, such as a budget deficit of less than three per cent of their GDP, a debt ratio of less than sixty per cent of GDP (both of which were ultimately widely flouted after introduction), low inflation, and interest rates close to the EU average. In the Maastricht Treaty, the United Kingdom and Denmark were granted exemptions per their request from moving to the stage of monetary union which would result in the introduction of the euro.

Economists who helped create or contributed to the euro include Fred Arditti, Neil Dowling, Wim Duisenberg, Robert Mundell, Tommaso Padoa-Schioppa and Robert Tollison. (For macroeconomic theory, see below.)

The name "euro" was officially adopted in Madrid on 16 December 1995. Belgian Esperantist Germain Pirlot, a former teacher of French and history is credited with naming the new currency by sending a letter to then President of the European Commission, Jacques Santer, suggesting the name "euro" on 4 August 1995.

Due to differences in national conventions for rounding and significant digits, all conversion between the national currencies had to be carried out using the process of triangulation via the euro. The definitive values of one euro in terms of the exchange rates at which the currency entered the euro are shown on the right.

The rates were determined by the Council of the European Union, based on a recommendation from the European Commission based on the market rates on 31 December 1998. They were set so that one European Currency Unit (ECU) would equal one euro. The European Currency Unit was an accounting unit used by the EU, based on the currencies of the member states; it was not a currency in its own right. They could not be set earlier, because the ECU depended on the closing exchange rate of the non-euro currencies (principally the pound sterling) that day.

The procedure used to fix the irrevocable conversion rate between the Greek drachma and the euro was different, since the euro by then was already two years old. While the conversion rates for the initial eleven currencies were determined only hours before the euro was introduced, the conversion rate for the Greek drachma was fixed several months beforehand.

The currency was introduced in non-physical form ( traveller's cheques, electronic transfers, banking, etc.) at midnight on 1 January 1999, when the national currencies of participating countries (the eurozone) ceased to exist independently. Their exchange rates were locked at fixed rates against each other. The euro thus became the successor to the European Currency Unit (ECU). The notes and coins for the old currencies, however, continued to be used as legal tender until new euro notes and coins were introduced on 1 January 2002.

The changeover period during which the former currencies' notes and coins were exchanged for those of the euro lasted about two months, until 28 February 2002. The official date on which the national currencies ceased to be legal tender varied from member state to member state. The earliest date was in Germany, where the mark officially ceased to be legal tender on 31 December 2001, though the exchange period lasted for two months more. Even after the old currencies ceased to be legal tender, they continued to be accepted by national central banks for periods ranging from several years to forever (the latter in Austria, Germany, Ireland and Spain). The earliest coins to become non-convertible were the Portuguese escudos, which ceased to have monetary value after 31 December 2002, although banknotes remain exchangeable until 2022.

Sovereign debt crisis

Following the US financial crisis in 2008, fears of a sovereign debt crisis developed in 2009 among fiscally conservative investors concerning some European states, with the situation becoming particularly tense in early 2010. This included eurozone members Greece, Ireland and Portugal and also some EU countries outside the area. Iceland, the country which experienced the largest crisis in 2008 when its entire international banking system collapsed, has emerged less affected by the sovereign-debt crisis as the government was unable to bail the banks out. In the EU, especially in countries where sovereign debts have increased sharply due to bank bailouts, a crisis of confidence has emerged with the widening of bond yield spreads and risk insurance on credit default swaps between these countries and other EU members, most importantly Germany. To be included in the euro zone, the countries had to fulfil certain convergence criteria, but the meaningfulness of such criteria was diminished by the fact they have not been applied to different countries with the same strictness.

According to the Economist Intelligence Unit in 2011, "[I]f the [euro area] is treated as a single entity, its [economic and fiscal] position looks no worse and in some respects, rather better than that of the US or the UK" and the budget deficit for the euro area as a whole is much lower and the euro area's government debt/GDP ratio of 86% in 2010 was about the same level as that of the US. "Moreover," they write, "private-sector indebtedness across the euro area as a whole is markedly lower than in the highly leveraged Anglo-Saxon economies." The authors conclude that the crisis "is as much political as economic" and the result of the fact that the euro area lacks the support of "institutional paraphernalia (and mutual bonds of solidarity) of a state".

The crisis continued with S&P downgrading nine euro-area countries, including France, then downgrading the entire European Financial Stability Facility (EFSF) fund.

In May 2012, socialist François Hollande was elected as president of France and a month later the French socialist legislative position was strengthened, while German leader Angela Merkel "has appeared to be floundering and been badly let down by her advisers in recent months", one commentator said. As such, "serious discord between French and German monetary decision-makers was [comparable to that of] ... 1992–93, at the height of the crisis over the European Monetary System, the forerunner to EMU" ( European Monetary Union). "[H]itherto relatively dormant signs of euro skepticism in German public opinion and throughout industry have been multiplying in recent months, making Hollande's proposals increasingly unpalatable to a broad swathe of German opinion. Although considerable controversy will continue to swirl over Greece and Spain, the real battle lines over the future of the euro will be drawn up between Germany and France," the commentary concluded. Another historical parallel – to 1931 when Germany was burdened with debt, unemployment and austerity while France and the US were relatively strong creditors – gained attention in summer 2012 even as Germany received a debt-rating warning of its own.

Direct and indirect usage

Direct usage

The euro is the sole currency of 17 EU member states: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Republic of Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. These countries comprise the " eurozone", some 326 million people in total.

With all but two of the remaining EU members obliged to join, together with future members of the EU, the enlargement of the eurozone is set to continue. Outside the EU, the euro is also the sole currency of Montenegro and Kosovo and several European micro states (Andorra, Monaco, San Marino and the Vatican City) as well as in three overseas territories of EU states that are not themselves part of the EU ( Mayotte, Saint Pierre and Miquelon and Akrotiri and Dhekelia). Together this direct usage of the euro outside the EU affects over 3 million people.

It is also gaining increasing international usage as a trading currency, in Cuba, North Korea and Syria. There are also various currencies pegged to the euro (see below). In 2009, Zimbabwe abandoned its local currency and used major currencies instead, including the euro and the United States dollar.

Use as reserve currency

Since its introduction, the euro has been the second most widely held international reserve currency after the US dollar. The share of the euro as a reserve currency has increased from 18% in 1999 to 27% in 2008. Over this period the share of the US dollar fell from 71% to 64% and the Yen fell from 6.4% to 3.3%. The euro inherited and built on the status of the Deutsche Mark as the second most important reserve currency. The euro remains underweight as a reserve currency in advanced economies while overweight in emerging and developing economies: according to the International Monetary Fund the total of euro held as a reserve in the world at the end of 2008 was equal to $1.1 trillion or €850 billion, with a share of 22% of all currency reserves in advanced economies, but a total of 31% of all currency reserves in emerging and developing economies.

The possibility of the euro becoming the first international reserve currency is now widely debated among economists. Former Federal Reserve Chairman Alan Greenspan gave his opinion in September 2007 that it is "absolutely conceivable that the euro will replace the US dollar as reserve currency, or will be traded as an equally important reserve currency." In contrast to Greenspan's 2007 assessment, the euro's increase in the share of the worldwide currency reserve basket has slowed considerably since 2007 and since the beginning of the worldwide credit crunch related recession and European sovereign-debt crisis.

Currencies pegged to the euro

Outside the eurozone, a total of 23 countries and territories that do not belong to the EU have currencies that are directly pegged to the euro including 14 countries in mainland Africa ( CFA franc and Moroccan dirham), two African island countries ( Comorian franc and Cape Verdean escudo), three French Pacific territories ( CFP franc) and another Balkan country, Bosnia and Herzegovina ( Bosnia and Herzegovina convertible mark). On 28 July 2009, São Tomé and Príncipe signed an agreement with Portugal which will eventually tie its currency to the euro.

With the exception of Bosnia (which pegged its currency against the Deutsche Mark) and Cape Verde (formerly pegged to the Portuguese escudo) all of these non-EU countries had a currency peg to the French Franc before pegging their currencies to the euro. Pegging a country's currency to a major currency is regarded as a safety measure, especially for currencies of areas with weak economies, as the euro is seen as a stable currency, prevents runaway inflation and encourages foreign investment due to its stability.

Within the EU several currencies have a peg to the euro, in most instances as a precondition to joining the eurozone. The Bulgarian lev was formerly pegged to the Deutsche Mark, other EU member states have a direct peg due to ERM II: the Danish krone, the Lithuanian litas and the Latvian lats.

In total, over 150 million people in Africa use a currency pegged to the euro, 25 million people outside the eurozone in Europe and another 500,000 people on Pacific islands.

Economics

Optimal currency area

In economics, an optimum currency area (or region) (OCA, or OCR) is a geographical region in which it would maximise economic efficiency to have the entire region share a single currency. There are two models, both proposed by Robert Mundell: the stationary expectations model and the international risk sharing model. Mundell himself advocates the international risk sharing model and thus concludes in favour of the euro. However, even before the creation of the single currency, there were concerns over diverging economies. Before the Late-2000s recession the chances of a state leaving the euro, or the chances that the whole zone would collapse, were considered extremely slim. However the Greek government-debt crisis led to former British foreign secretary Jack Straw claiming the Eurozone could not last in its current form. Part of the problem seems to be the rules that were created when the Euro was set up. John Lanchester, writing for The New Yorker explains it thus:

The guiding principle of the currency, which opened for business in 1999, were supposed to be a set of rules to limit a country's annual deficit to three per cent of gross domestic product, and the total accumulated debt to sixty per cent of G.D.P. It was a nice idea, but by 2004 the two biggest economies in the euro zone, Germany and France, had broken the rules for three years in a row.

Transaction costs and risks

| Rank | Currency | ISO 4217 code (Symbol) |

% daily share (April 2010) |

|---|---|---|---|

|

1

|

USD ($)

|

84.9% | |

|

2

|

EUR (€)

|

39.1% | |

|

3

|

JPY (¥)

|

19.0% | |

|

4

|

GBP (£)

|

12.9% | |

|

5

|

AUD ($)

|

7.6% | |

|

6

|

CHF (Fr)

|

6.4% | |

|

7

|

CAD ($)

|

5.3% | |

|

8

|

HKD ($)

|

2.4% | |

|

9

|

SEK (kr)

|

2.2% | |

|

10

|

NZD ($)

|

1.6% | |

|

11

|

KRW (₩)

|

1.5% | |

|

12

|

SGD ($)

|

1.4% | |

|

13

|

NOK (kr)

|

1.3% | |

|

14

|

MXN ($)

|

1.3% | |

|

15

|

INR (

|

0.9% | |

| Other | 12.2% | ||

| Total | 200% | ||

The most obvious benefit of adopting a single currency is to remove the cost of exchanging currency, theoretically allowing businesses and individuals to consummate previously unprofitable trades. For consumers, banks in the eurozone must charge the same for intra-member cross-border transactions as purely domestic transactions for electronic payments (e.g. credit cards, debit cards and cash machine withdrawals).

The absence of distinct currencies also removes exchange rate risks. The risk of unanticipated exchange rate movement has always added an additional risk or uncertainty for companies or individuals that invest or trade outside their own currency zones. Companies that hedge against this risk will no longer need to shoulder this additional cost. This is particularly important for countries whose currencies had traditionally fluctuated a great deal, particularly the Mediterranean nations.

Financial markets on the continent are expected to be far more liquid and flexible than they were in the past. The reduction in cross-border transaction costs will allow larger banking firms to provide a wider array of banking services that can compete across and beyond the eurozone.

Price parity

Another effect of the common European currency is that differences in prices—in particular in price levels—should decrease because of the law of one price. Differences in prices can trigger arbitrage, i.e. speculative trade in a commodity across borders purely to exploit the price differential. Therefore, prices on commonly traded goods are likely to converge, causing inflation in some regions and deflation in others during the transition. Some evidence of this has been observed in specific eurozone markets.

Macroeconomic stability

Low levels of inflation are the hallmark of stable and modern economies. Because a high level of inflation acts as a tax ( seigniorage) and theoretically discourages investment, it is generally viewed as undesirable. In spite of the downside, many countries have been unable or unwilling to deal with serious inflationary pressures. Some countries have successfully contained them by establishing largely independent central banks. One such bank was the Bundesbank in Germany; as the European Central Bank is modelled on the Bundesbank, it is independent of the pressures of national governments and has a mandate to keep inflation low. Member countries that join the euro hope to enjoy the macroeconomic stability associated with low levels of inflation. The ECB (unlike the Federal Reserve in the United States of America) does not have a second objective to sustain growth and employment.

Many national and corporate bonds denominated in euro are significantly more liquid and have lower interest rates than was historically the case when denominated in national currencies. While increased liquidity may lower the nominal interest rate on the bond, denominating the bond in a currency with low levels of inflation arguably plays a much larger role. A credible commitment to low levels of inflation and a stable debt reduces the risk that the value of the debt will be eroded by higher levels of inflation or default in the future, allowing debt to be issued at a lower nominal interest rate.

Unfortunately, there is also a cost in structurally keeping inflation lower than in the US, UK and China. The result is that seen from those countries, the euro has become expensive, making European products increasingly expensive for its largest importers. Hence export from the euro zone becomes more difficult. This is one of the main reasons why economic growth inside the euro zone now lags behind growth in other large economies. This effect is strongest in European countries with a weak economy.

In general, those in Europe who own large amounts of euros, are served by high stability and low inflation. Those who now need to earn euros, including those countries who need to pay interest on large debts, are likely better served with a slightly less strong euro leading to more export. Because with a lower euro, investors would see better chances for (companies in) southern European countries to grow themselves out of the crisis. As a result, investing there, would become less risky, and that would push interest rates for southern countries more in line with the European average.

The contradiction here is, that high macroeconomic stability in the form of ongoing historically low inflation, over time leads to economic problems, creating higher interest rates and political and economic instability for the weaker partners.

Trade

A 2009 consensus from the studies of the introduction of the euro concluded that it has increased trade within the eurozone by 5% to 10%, although one study suggested an increase of only 3% while another estimated 9 to 14%. However, a meta-analysis of all available studies suggests that the prevalence of positive estimates is caused by publication bias and that the underlying effect may be negligible.

Investment

Physical investment seems to have increased by 5% in the eurozone due to the introduction. Regarding foreign direct investment, a study found that the intra-eurozone FDI stocks have increased by about 20% during the first four years of the EMU. Concerning the effect on corporate investment, there is evidence that the introduction of the euro has resulted in an increase in investment rates and that it has made it easier for firms to access financing in Europe. The euro has most specifically stimulated investment in companies that come from countries that previously had weak currencies. A study found that the introduction of the euro accounts for 22% of the investment rate after 1998 in countries that previously had a weak currency.

Inflation

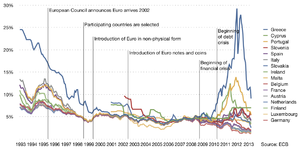

The introduction of the euro has led to extensive discussion about its possible effect on inflation. In the short term, there was a widespread impression in the population of the eurozone that the introduction of the euro had led to an increase in prices, but this impression was not confirmed by general indices of inflation and other studies. A study of this paradox found that this was due to an asymmetric effect of the introduction of the euro on prices: while it had no effect on most goods, it had an effect on cheap goods which have seen their price round up after the introduction of the euro. The study found that consumers based their beliefs on inflation of those cheap goods which are frequently purchased. It has also been suggested that the jump in small prices may be because prior to the introduction, retailers made fewer upward adjustments and waited for the introduction of the euro to do so.

Exchange rate risk

One of the advantages of the adoption of a common currency is the reduction of the risk associated with changes in currency exchange rates. It has been found that the introduction of the euro created "significant reductions in market risk exposures for nonfinancial firms both in and outside of Europe" These reductions in market risk "were concentrated in firms domiciled in the eurozone and in non-Euro firms with a high fraction of foreign sales or assets in Europe".

Financial integration

The introduction of the euro seems to have had a strong effect on European financial integration. According to a study on this question, it has "significantly reshaped the European financial system, especially with respect to the securities markets [...] However, the real and policy barriers to integration in the retail and corporate banking sectors remain significant, even if the wholesale end of banking has been largely integrated." Specifically, the euro has significantly decreased the cost of trade in bonds, equity, and banking assets within the eurozone. On a global level, there is evidence that the introduction of the euro has led to an integration in terms of investment in bond portfolios, with eurozone countries lending and borrowing more between each other than with other countries.

Effect on interest rates

The introduction of the euro has decreased the interest rates of most members countries, in particular those with a weak currency. As a consequence the market value of firms from countries which previously had a weak currency has very significantly increased. The countries whose interest rates fell most as a result of the euro are Greece, Ireland, Portugal, Spain, and Italy. The effect of such low interest rates made it easier for banks within the countries in which interest rates fell and the countries themselves to borrow significant amounts (above the 3% of GDP budget deficit imposed on the eurozone initially) and increase their public deficit and levels of privately held consumer debt. Following the Late-2000s financial crisis, governments in these countries found it necessary to bail out or nationalise their privately held banks to prevent systemic failure of the banking system. This further increased the already high levels of public debt to a level the markets began to consider unsustainable, via increasing government bond interest rates, producing the ongoing European sovereign-debt crisis.

Price convergence

The evidence on the convergence of prices in the eurozone with the introduction of the euro is mixed. Several studies failed to find any evidence of convergence following the introduction of the euro after a phase of convergence in the early 1990s. Other studies have found evidence of price convergence, in particular for cars. A possible reason for the divergence between the different studies is that the processes of convergence may not have been linear, slowing down substantially between 2000 and 2003, and resurfacing after 2003 as suggested by a recent study (2009).

Tourism

A study suggests that the introduction of the euro has had a positive effect on the amount of tourist travel within the EMU, with an increase of 6.5%.

Exchange rates

Flexible exchange rates

The ECB targets interest rates rather than exchange rates and in general does not intervene on the foreign exchange rate markets. This is because of the implications of the Mundell–Fleming model, which implies a central bank cannot (without capital controls) maintain interest rate and exchange rate targets simultaneously, because increasing the money supply results in a depreciation of the currency. In the years following the Single European Act, the EU has liberalised its capital markets, and as the ECB has chosen monetary autonomy, the exchange-rate regime of the euro is flexible, or floating. The result of the ECB maintaining historically low interest rates and restricting money supply, has been that over the last decade the euro has become expensive relative to the currency of Europe's main trading partners.

Against other major currencies

The euro is one of the major reserve currencies together with the US dollar, Japanese yen, Pound sterling and Swiss franc. After its introduction on 4 January 1999 its exchange rate against the other major currencies fell reaching its lowest exchange rates in 2000 (25 October vs the US Dollar, 26 October vs Japanese Yen, 3 May vs Pound Sterling). Afterwards it regained and its exchange rate reached its historical highest point in 2008 (15 July vs US Dollar, 23 July vs Japanese Yen, 29 December vs Pound Sterling). With the advent of the global financial crisis the euro initially fell, only to regain later. Despite pressure due to the European sovereign-debt crisis the euro remained stable. In November 2011 the euro's exchange rate index – measured against currencies of the bloc's major trading partners – was trading almost two percent higher on the year, approximately at the same level as it was before the crisis kicked off in 2007.

- Current and historical exchange rates against 29 other currencies (European Central Bank)

- Current dollar/euro exchange rates (BBC)

- Historical exchange rate from 1971 until now

| Current EUR exchange rates | |

|---|---|

| From Google Finance: | AUD CAD CHF GBP HKD JPY USD RUB INR CNY |

| From Yahoo! Finance: | AUD CAD CHF GBP HKD JPY USD RUB INR CNY |

| From XE.com: | AUD CAD CHF GBP HKD JPY USD RUB INR CNY |

| From OANDA.com: | AUD CAD CHF GBP HKD JPY USD RUB INR CNY |

| From fxtop.com: | AUD CAD CHF GBP HKD JPY USD RUB INR CNY |

Linguistic issues

The formal titles of the currency are euro for the major unit and cent for the minor (one hundredth) unit and for official use in most eurozone languages; according to the ECB, all languages should use the same spelling for the nominative singular. This may contradict normal rules for word formation in some languages; e.g., those where there is no eu diphthong. Bulgaria has negotiated an exception; euro in the Cyrillic alphabet is spelled as eвро (evro) and not eуро (euro) in all official documents. The Greek "cent" coins are denominated in "lepto/a." Official practice for English-language EU legislation is to use the words euro and cent as both singular and plural, although the European Commission's Directorate-General for Translation states that the plural forms euros and cents should be used in English.