Wall Street Crash of 1929

Did you know...

SOS Children, which runs nearly 200 sos schools in the developing world, organised this selection. Visit the SOS Children website at http://www.soschildren.org/

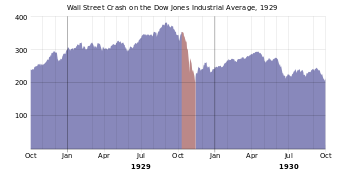

The Wall Street Crash of 1929, also known as the Crash of ’29 or the Great Crash, was the most devastating stock market crash in the history of the United States, taking into consideration the full scope and longevity of its fallout. Three phrases—Black Thursday, Black Monday, and Black Tuesday—are used to describe this collapse of stock values. All three are appropriate, for the crash was not a one-day affair. The initial crash occurred on Black Thursday ( October 24, 1929), but it was the catastrophic downturn of Black Monday and Tuesday ( October 28 and October 29, 1929) that precipitated widespread panic and the onset of unprecedented and long-lasting consequences for the United States. The collapse continued for a month. Economists and historians disagree as to what role the crash played in subsequent economic, social, and political events. The crash in America came near the beginning of the Great Depression, a period of economic decline in the industrialized nations, and led to the institution of landmark financial reforms and new trading regulations. At the time of the crash, New York City had grown to be a major metropolis, and its Wall Street district was one of the world's leading financial centers. The New York Stock Exchange (NYSE) was the largest stock market in the world. The Roaring Twenties was a time of prosperity and excess in the city, and, despite warnings against speculation, many believed that the market could sustain high price levels. Shortly before the crash, Irving Fisher famously proclaimed, "Stock prices have reached what looks like a permanently high plateau." The euphoria and financial gains of the great bull market were shattered Black Thursday, when share prices on the NYSE collapsed. Stock prices fell on that day and they continued to fall, at an unprecedented rate, for a full month.

In the days leading up to Black Thursday, the market was severely unstable. Periods of selling and high volumes of trading were interspersed with brief periods of rising prices and recovery. Economist and author Jude Wanniski later correlated these swings with the prospects for passage of the Smoot-Hawley Tariff Act, which was then being debated in Congress. After the crash, the Dow Jones Industrial Average (DJIA) recovered early in 1930, only to reverse again, reaching a low point of the great bear market in 1932. The Dow did not return to pre-1929 levels until late 1954, and was lower at its July 8, 1932 level than it had been since the 1800s.

| “ | Anyone who bought stocks in mid-1929 and held onto them saw most of his or her adult life pass by before getting back to even. | ” |

|

— Richard M. Salsman |

||

Timeline

After an amazing five-year run when the world saw the Dow Jones Industrial Average (DJIA) increase in value fivefold, prices peaked at 381.17 on September 3, 1929. The market then fell sharply for a month, losing 17% of its value on the initial leg down. Prices then recovered more than half of the losses over the next week, only to turn back down immediately afterwards. The decline then accelerated into the so-called "Black Thursday", October 24 1929. A record number of 12.9 million shares were traded on that day. At 1 p.m. on Friday, October 25, several leading Wall Street bankers met to find a solution to the panic and chaos on the trading floor. The meeting included Thomas W. Lamont, acting head of Morgan Bank; Albert Wiggin, head of the Chase National Bank; and Charles E. Mitchell, president of the National City Bank. They chose Richard Whitney, vice president of the Exchange, to act on their behalf. With the bankers' financial resources behind him, Whitney placed a bid to purchase a large block of shares in U.S. Steel at a price well above the current market. As amazed traders watched, Whitney then placed similar bids on other " blue chip" stocks. This tactic was similar to a tactic that ended the Panic of 1907, and succeeded in halting the slide that day. In this case, however, the respite was only temporary.

Over the weekend, the events were covered by the newspapers across the United States. On Monday, October 28, more investors decided to get out of the market, and the slide continued with a record loss in the Dow for the day of 13%. The next day, "Black Tuesday", October 29 1929, 16.4 million shares were traded, a number that broke the record set five days earlier and that was not exceeded until 1969. Author Richard M. Salsman wrote that on October 29—amid rumors that U.S. President Herbert Hoover would not veto the pending Hawley-Smoot Tariff bill—stock prices crashed even further." William C. Durant joined with members of the Rockefeller family and other financial giants to buy large quantities of stocks in order to demonstrate to the public their confidence in the market, but their efforts failed to stop the slide. The DJIA lost another 12% that day. The ticker did not stop running until about 7:45 that evening. The market lost $14 billion in value that day, bringing the loss for the week to $30 billion, ten times more than the annual budget of the federal government, far more than the U.S. had spent in all of World War I.

An interim bottom occurred on November 13, with the Dow closing at 198.6 that day. The market recovered for several months from that point, with the Dow reaching a secondary peak at 294.0 in April 1930. The market embarked on a steady slide in April 1931 that did not end until 1932 when the Dow closed at 41.22 on July 8, concluding a shattering 89% decline from the peak. This was the lowest the stock market had been since the 19th century.

Economic fundamentals

The crash followed a speculative boom that had taken hold in the late 1920s, which had led hundreds of thousands of Americans to invest heavily in the stock market, a significant number even borrowing money to buy more stock. By August 1929, brokers were routinely lending small investors more than 2/3 of the face value of the stocks they were buying. Over $8.5 billion was out on loan, more than the entire amount of currency circulating in the U.S.The rising share prices encouraged more people to invest; people hoped the share prices would rise further. Speculation thus fueled further rises and created an economic bubble. The average P/E (price to earnings) ratio of S&P Composite stocks was 32.6 in September 1929, clearly above historical norms. Most economists view this event as the most dramatic in modern economic history. On October 24, 1929 (with the Dow just past its September 3 peak of 381.17), the market finally turned down, and panic selling started. 12,894,650 shares were traded in a single day as people desperately tried to mitigate the situation. This mass sale was considered a major contributing factor to the Great Depression. Economists and historians, however, frequently differ in their views of the crash's significance in this respect. Some hold that political over-reactions to the crash, such as the passage of the Smoot-Hawley Tariff Act through the U.S. Congress, caused more harm than the crash itself.

Official investigation of the Crash

In 1931, the Pecora Commission was established by the U.S. Senate to study the causes of the crash. The U.S. Congress passed the Glass-Steagall Act in 1933, which mandated a separation between commercial banks, which take deposits and extend loans, and investment banks, which underwrite, issue, and distribute stocks, bonds, and other securities.

After the experience of the 1929 crash, stock markets around the world instituted measures to temporarily suspend trading in the event of rapid declines, claiming that they would prevent such panic sales. The one-day crash of Black Monday, October 19, 1987, however, was even more severe than the crash of 1929, when the Dow Jones Industrial Average fell a full 22.6%. (The markets quickly recovered, posting the largest one-day increase since 1932 only two days later.)

Impact and academic debate

The Wall Street Crash had a major impact on the U.S. and world economy, and it has been the source of intense academic debate—historical, economic and political—from its aftermath until the present day. The crash marked the beginning of widespread and long-lasting consequences for the United States. The main question is: Did the crash cause the depression, or did it merely coincide with the bursting of a credit-inspired economic bubble? The decline in stock prices caused bankruptcies and severe macroeconomic difficulties including business closures, firing of workers and other economic repression measures. The resultant rise of mass unemployment and the depression is seen as a direct result of the crash, though it is by no means the sole event that contributed to the depression; it is usually seen as having the greatest impact on the events that followed. Therefore the Wall Street Crash is widely regarded as signaling the downward economic slide that initiated the Great Depression.

Many academics see the Wall Street Crash of 1929 as part of a historical process that was a part of the new theories of Boom and bust. According to economists such as Joseph Schumpeter and Nikolai Kondratieff the crash was merely a historical event in the continuing process known as Economic cycles. The impact of the crash was merely to increase the speed at which the cycle proceeded to its next level. According to the economist Milton Friedman in Monetary History of the United States in 1963, the Federal Reserve in the immediate aftermath of the crash rapidly contracted the money supply and so turned the recession into a depression.